When Policies Collide – Untangling “Other Insurance” Clauses

At our recent London Symposium, Associate Abigail Smith discussed the potential challenges posed by other insurance clauses in insurance policies. The session covered:

- The genesis of these clauses;

- The types of other insurance clauses used to limit an insurer’s liability in the event of double insurance; and

- How competing other insurance clauses are interpreted, in practice.

What is double insurance?

Double insurance occurs when the same party is insured with two or more insurers in respect of the same interest on the same subject matter against the same risk. In other words, it occurs where an insured’s loss is covered under two or more separate policies. Whilst it can be a commercially prudent guard against insurer insolvency, it most often arises inadvertently (for example, where a composite policy overlaps with dedicated cover).

The common law position

Under common law, a policyholder that is double insured for its loss can claim against whichever policy or policies it chooses, in whichever order it chooses, subject to each policy’s limits. Then, to ensure the risk is fairly distributed between insurers, the paying insurer is entitled to claim a contribution from the non-paying insurer (a principle known as rateable contribution – Drake v Provident [2003]).

Industry challenges

Unfortunately, the common law position gives rise to some complicated issues.

The main issue is that, because there is no general rule or common law duty requiring a policyholder to disclose that it is double insured, unless an insurer asks the question directly, or notification of other insurance is a condition of the policy, a paying insurer may not be aware that they are entitled to claim a contribution.

Adding another layer of complexity, the limitation period for bringing a contribution claim is two years from the date that the right accrued under section 10(1) Limitation Act 1980. That date, which is likely to be the date of a judgment, settlement or arbitration award, is not necessarily when an insurer becomes aware that they are entitled to a contribution. In fact, with no duty to disclose, it is possible for limitation to expire without an insurer ever knowing that it had been entitled to a contribution.

Types of “other insurance” clauses

It was in recognising these challenges that the industry came up with a solution: other insurance clauses, which are standard clauses in insurance policies which limit an insurer’s liability in circumstances where another policy covers the same loss.

In The National Farmers Union Mutual Insurance Society Limited v HSBC Insurance (UK) Limited [2011], Gavin Kealey KC identified 3 main types of other insurance clauses, being:

- Escape Clauses – those that exclude cover altogether in the event that another policy covers the same loss.

- Excess Clauses – those that state that the policy will only respond in excess of any other insurance.

- Rateable Proportion Clauses – those that limit an insurer’s liability in proportion to the total cover available.

Abigail explored how each type of clause is interpreted, and how competing clauses interact, in practice.

Escape Clauses

Owing to the fact that Escape Clauses seek to exclude cover altogether in the event of double insurance, there was at the outset the potential for policyholders to be left without any cover at all where two or more policies each included an Escape Clause.

That issue was addressed in Weddell v Road Transport [1932], with the Court ruling that it would be unreasonable to leave a policyholder without any primary cover in circumstances where multiple policies were in place and multiple premiums had been paid. As such, where two or more policies include an Escape Clause, they will cancel each other out so that the policyholder can claim against whichever policy (or policies) it chooses (essentially reverting to the common law position).

Excess Clauses

The same question was more recently considered in Watford Community Housing v Athur J Gallagher Insurance Brokers Limited [2025], this time in respect of Excess Clauses. Ultimately, the Commercial Court held that, because Excess Clauses also seek to avoid primary liability in the event of other insurance, they cancel each other out in the same way that Escape Clauses do.

Escape Clause v Excess Clause

Whilst there’s no English authority addressing a scenario in which two or more policies include competing Escape and Excess Clauses, Australian caselaw does provide some assistance.

In Allianz Insurance Australia Ltd v Certain Underwriters at Lloyds of London [2019] the New South Wales Court of Appeal held that competing Escape and Excess Clauses would also cancel each other out on the basis that both seek to avoid primary liability in the event of double insurance – an Escape Clause seeks to avoid any liability, whilst an Excess Clause recognises only a secondary one.

The New Zealand courts, by contrast Abigail noted, have on one occasion reached the conclusion that an Escape Clause will prevail (albeit relying heavily on the insurance provisions in an underlying contract). As such, the outcome will always come down to the specific policy wording and the wider context; “there is no universal hierarchy that automatically applies.”

Rateable Proportion Clauses

The final type of other insurance clause limits an insurer’s share of the loss in proportion to the policy limit. For example:

- An insured incurred £900,000 of loss covered under two separate policies.

- Policy A with a limit of £1m, and Policy B with a limit of £2m.

- Policy A’s insurer would be liable for 1/3 of the loss (their £1m portion of the total £3m insured), which is £300,000, and Policy B’s insurer would be liable for 2/3 which is £600,000.

If Policy A contained a Rateable Proportion Clause, and Policy B was silent, Policy B’s insurer would have to pay the whole of the loss and then claim a contribution from Policy A’s insurer.

Rateable Proportion Clause v Escape / Excess Clause

Unlike Escape and Excess Clauses, Rateable Proportion Clauses acknowledge that an insurer does have a primary liability in the event of other insurance, albeit a limited one. For that reason, an Escape or Excess Clause will prevail over a Rateable Proportion Clause.

If Policy A included a Rateable Proportion Clause whilst Policy B included an Escape Clause, the effect of the Escape Clause is that there would be no double insurance and Policy A’s insurer would be liable for the loss without being entitled to claim a contribution from Policy B’s insurer.

Whilst there has been some controversy over how an Excess Clauses might compete with a Rateable Proportion Clause (Austin v Zurich [1944]), in NFU v HSBC, Gavin Kealey KC sought to clarify the position. He remarked that, as a matter of construction, an Excess Clause should prevail over a Rateable Proportion Clause because a Rateable Proportion Clause recognises that an insurer has a primary liability in the event of double insurance, whereas an Excess Clause does not.

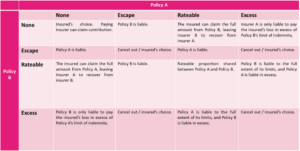

Abigail produced the table below as a starting guide for interpreting competing clauses, but was careful to note that the position will always depend on the policy wording, and the wider context.

Remaining questions

One issue that the courts are yet to address is whether, where an insured has multiple policies forming a horizontal primary layer of cover, followed by an excess layer that sits above, the entire horizontal layer must be exhausted before the excess policy responds.

The issue hasn’t arisen in caselaw to date, but Abigail remarked that it will be interesting to see how the courts approach the question when the times comes.

Key takeaways

The good news, for policyholders, is that the courts have so far refused to entertain any scenario in which an insured is left without primary cover.

That doesn’t mean, Abigail warns, that other insurance is an insurer’s problem. In circumstances where an Escape or Excess Clause prevails, an insured can be left without access to a policy that it paid a premium for, and which may well be preferable on its terms. Similarly, the disadvantage of Rateable Proportion Clauses from an insureds point of view is that the risk of insurer insolvency transfers back to the insured.

For those reasons, it is worth understanding whether there is another policy that responds to a risk and, if so, how any other insurance provisions might be interpreted.

Author

Abigail Smith, Associate

Court pours cold water on insurer’s fraud claims: Malhotra Leisure Ltd v Aviva

Court pours cold water on insurer’s fraud claims: Malhotra Leisure Ltd v Aviva

During the Covid-19 lockdown in July 2020, water escaped from a cold-water storage tank at one of the Claimant’s hotels causing significant damage.

Aviva, the Claimant’s insurer under a property damage and business interruption policy, refused to indemnify the Claimant on the basis that:

1. the escape of water was deliberately and dishonestly induced by the Claimant; and

2. there were associated breaches by the Claimant of a fraud condition in the policy.

The Commercial Court dealt with each of the issues as follows.

Was the escape of water accidental or deliberate?

Aviva bore the burden of proof and had to show that, on a balance of probabilities, the escape of water was the result of an intentional act carried out either by, or at the direction of, the Claimant or its agents.

In considering whether the escape of water was accidental or deliberate, the Deputy Judge, Nigel Cooper KC, held that there was a distinction to be drawn between whether the Claimant’s witnesses were credible, and the question of whether they were sufficiently dishonest that they were prepared to deliberately cause the incident and thereafter lie about their involvement both during the investigation and then throughout the litigation. In reaching that view, he considered the following established principles:

a) if fraud is to be made out, the evidence must exclude any substantial plausible explanation for how the escape of water may have occurred accidentally; and

b) when assessing the evidence, the Court should take into account as probative tools the following factors:

i) whether there is evidence of a plausible financial motive for the Claimant to damage its own property;

ii) the fact that owners of property do not generally destroy their own property and an allegation that they have done so is a serious charge to make;

iii) instances of lesser wrong-doing may not be probative of an allegation that an insured has deliberately destroyed property to defraud insurers; and

iv) in considering where the balance of probabilities lies, it is important to consider the evidence as a whole, putting the available evidence as to the physical cause of the escape of water into the context of the surrounding circumstances and commercial background.

In considering (a) the Judge was satisfied that it was possible, based on the plumbing evidence and the fact that Aviva’s own expert accepted that the escape of water could have been accidental, that the incident was fortuitous.

Evidence of a plausible financial motive

In circumstances where there was no direct evidence as to how the escape of water was caused, the question as to whether there was a financial motive became correspondingly more significant. Aviva submitted that there was a “preponderance of evidence” that the Claimant was struggling financially in the lead up to the incident, and that from March 2020 onwards the Claimant and its wider group had been placed under significant financial pressure as a result of the pandemic. To the contrary, the evidence showed that the Claimant’s group had extensive cash reserves (£7.5 million in cash and £150 million in tangible assets at the time of the incident) with a turnover of £38 million.

The Court held that the cash reserves represented a substantial hurdle to Aviva’s case that the Claimant’s controlling shareholder, Mr Malhotra, had motive to commit fraud to obtain a payment in relation to damage to the hotel. To that end, the Judge pointed out that any payment made would have been diminished in covering the immediate clean-up costs (which had already been incurred by the Claimant) and the costs of repair and refurbishment. There was therefore no evidence of a financial motive sufficient to explain why the Claimant would have caused the incident. In fact, all necessary steps to reinstate the hotel had been taken, without the benefit of an interim payment from Aviva.

The proper approach to the construction of fraud conditions

The Fraud Condition

The policy included a fraud condition, which read:

"If a claim made by You or anyone acting on your behalf is fraudulent or fraudulently exaggerated or supported by a false statement or fraudulent means or fraudulent evidence is provided to support the claim, We may:

(1) refuse to pay the claim”

(the “Fraud Condition”).

In addition to the allegation that the escape of water was deliberately induced by the Claimant, Aviva made various submissions in respect of statements made by the Claimant’s employees and associates to Aviva’s loss adjusters. Those allegations included:

1. That the Claimant’s Estates Manager, Mr. Vadhera, who discovered the escape of water, was not an honest witness and had good reasons to be willing to lie in order to support the Claimant's insurance claim, including that:

a) he had been the Claimant’s Estates Manager since 2019, overseeing 20 members of staff, and was responsible for 20 - 30 properties;

b) there was a close personal relationship between Mr Malhotra and Mr. Vadhera dating back nearly three decades;

c) Mr Vadhera was personally and financially indebted to the Claimant, due to various substantial loans;

d) Mr Vadhera was the sole director of a construction company owned by Mr Malhotra;

e) his testimony was that, upon discovery of the escape of water, he saw the cold water tank overspill, which on Aviva’s case, would not have occurred without the connected tanks also overspilling (when in fact, the Judge found that the tank in question did overspill); and

f) he told loss adjusters that he had apologised to Mr Malhotra for disturbing his birthday on the day of the incident, when in fact it was not Mr Malhotra’s actual birthday (incidentally, it was found that Mr Malhotra was indeed celebrating his 60th birthday on that day).

2. That Atul Malhotra, Mr Malhotra’s son and the sole director of the Claimant, had lied about the whereabouts of the valve that had caused the escape of water (when in fact, he had simply not appreciated what the plumbers had handed him during the cleaning works, it being in a dissembled state and in a plastic bag).

3. That Mr Malhotra lied to loss adjusters about Mr Vadhera finding insulation in the overflow of the cold-water tank (when in fact, the evidence supported that there was indeed insulation in the overflow, there was no benefit to the Claimant in it being Mr Vadhera who discovered it, and in any event who discovered it was immaterial to the claim).

4. That Mr Malhotra told loss adjusters that Mr Vadhera told him of what he had discovered on 12 July 2020, when it must have been 11 July 2020 (which was immaterial to the claim and provided no benefit to the Claimant).

Regardless, Aviva’s position was that the Fraud Condition had been breached such that it was entitled to refuse the claim.

An extension of the common law position

The common law has long prohibited recovery from an insurer where the insured’s claim has been fabricated or dishonestly exaggerated, a principle known as the fraudulent claims rule. In The Aegeon [2002] EWHC 1558 (Comm) Mance LJ extended that rule to apply to ‘collateral lies’ (i.e. fraudulent statements made in support of claims which are otherwise valid) which are material in that they:

a) directly relate to the claim;

b) are intended to improve the assured’s prospects of obtaining a settlement or winning the case; and

c) if believed, are objectively capable of yielding a not insignificant improvement in the insured’s prospects of obtaining a settlement or better settlement.

However, Versloot Dredging BV v HDI Gerling [2017] 1 AC 1 abolished that doctrine, establishing that the fraudulent claims rule does not apply to collateral lies. Giving a dissenting judgment, Lord Mance indicated that he would have upheld the test in The Aegeon, subject to potentially raising the threshold of materiality from a requirement for 'a not insignificant improvement' to the insured's prospects, requiring instead ‘a significant improvement’.

After Versloot, policy provisions purportedly allowing an insurer to reject a claim pursuant to collateral lies go further than the common law position. In Malhotra Leisure, the Judge accepted the Claimant’s submission that - in the absence of very clear words to the contrary - fraud conditions which seek to write in a power to decline claims on the basis of collateral lies should be read as taking effect subject to the limitations of the old common law doctrine, as set out in The Aegeon and modified in Versloot.

The specific wording of the Fraud Condition

The Judge further considered whether, by referring to a 'false' as opposed to 'fraudulent' or 'dishonest' statement in the Fraud Condition, the parties were intending that any false statement, including a statement made carelessly or without knowing it to be untrue, should be enough to entitle Aviva to reject a claim.

In finding that this was not the intention, he referred to the language of the Fraud Condition, which makes clear that it is dealing with fraudulent claims and collateral lies. In other words, the Court held that the Fraud Condition intended to address a situation where there was dishonesty, and did not apply to false statements made carelessly or innocently. Further, the wording of the Fraud Condition required that any false statement support the Claimant’s claim. In other words, it only applied to false statements made to assist in persuading Aviva to pay the claim, consistent with the common law position (both before and after Versloot).

Since there was no evidence of dishonesty on behalf of Mr Malhotra or any of the Claimant’s employees and/or associates, the Judge held that the Fraud Condition had not been breached and the Claimant was entitled to an indemnity in respect of the claim.

Key takeaways for policyholders

The obiter guidance in Malhotra Leisure on the interpretation of fraud conditions in insurance policies provides welcome protection for policyholders and reads as a cautionary tale for insurers. Allegations of dishonesty and fraud cannot be pleaded lightly, and there are professional obligations on insurers to first ensure that reasonably credible evidence exists establishing a prima facie case of fraud.

Following Malhotra Leisure, it is clear that courts will interpret conditions seeking to provide an insurer with the power to decline claims on the basis of collateral lies, subject to limitations of the old common law doctrine. In short, any collateral lie covered by a fraud condition must directly relate to the claim, be intended to improve the insured’s prospects and be capable of yielding a significant improvement in the insured’s prospects of obtaining a settlement or better settlement. Many of the allegations made in this case, including immaterial points such as whether Mr Malhotra was celebrating his birthday, and whether he was told certain facts on one day or the next, were never going to pass that test, and only served to distract from what was an otherwise covered claim.

Citation: Malhotra Leisure Ltd v Aviva Insurance Limited [2025] EWHC 1090 (Comm)

Abiigail Smith is an Associate at Fenchurch Law

The Good, the Bad & the Ugly: #25 The Good turned Ugly: Lonham Group Ltd v Scotbeef Ltd & DS Storage Ltd (in liquidation) [2025] EWCA Civ 203

Welcome to the latest in the series of blogs from Fenchurch Law: 100 cases every policyholder needs to know. An opinionated and practical guide to the most important insurance decisions relating to the London / English insurance markets, all looked at from a pro-policyholder perspective.

Some cases are correctly decided and positive for policyholders. We celebrate those cases as The Good.

In our view, some cases are bad for policyholders, wrongly decided and in need of being overturned. We highlight those decisions as The Bad.

Other cases are bad for policyholders but seem (even to our policyholder-tinted eyes) to be correctly decided. Those cases can trip up even the most honest policyholder with the most genuine claim. We put the hazard lights on those cases as The Ugly.

#25 The Good turned Ugly: Lonham Group Limited v Scotbeef Limited & DS Storage Limited (in liquidation)

Introduction

In a highly anticipated appeal concerning the Insurance Act 2015 (“the Act”), the Court of Appeal has offered the first guidance on the operation of Parts 2 and 3, and the characterisation of representations, warranties and conditions precedent.

Background

D&S Storage Limited (“D&S”) provided refrigeration and transport services to Scotbeef Limited (“Scotbeef”), who are producers and distributors of meat. In October 2019, D&S transferred six pallets of mould contaminated meat to Scotbeef. The meat was unfit for consumption by humans and/or animals and was consequently destroyed, leading Scotbeef to issue a claim against D&S for £395,588.

Initially, D&S sought to limit its liability to £25,000 on the basis that the Food Storage and Distribution Federation terms (“FSDF Terms”) (which included a £250 per tonne liability limit for defective meat) had been incorporated into its contract with Scotbeef. The Court disagreed, finding that the FSDF Terms were not incorporated into the contract, and that Scotbeef’s claim was not limited in value.

The first instance decision triggered D&S’ insolvency, and Scotbeef sought to pursue the claim directly against D&S’ insurer, Lonham Group Limited (“the Insurer”) pursuant to the Third Parties (Rights Against Insurers) Act 2010.

The Insurer defended the claim on the basis that D&S had failed to comply with a condition precedent in the Policy by not incorporating the FSDF Terms into the contract.

The Policy

The Policy contained a “Duty of Assured” clause that read:

"Conditions

General Conditions, Exclusions, and Observance…

DUTY OF ASSURED CLAUSE

It is a condition precedent to liability of [the Insurer] hereunder:-

(i) that [D&S] makes a full declaration of all current trading conditions at inception of the policy period;

(ii) that during the currency of this policy [D&S] continuously trades under the conditions declared and approved by [the Insurer] in writing;

(iii) that [D&S] shall take all reasonable and practicable steps to ensure that their trading conditions are incorporated in all contracts entered into by [it]. Reasonable steps are considered by [the Insurer] to be the following but not limited to… [various examples relating to incorporation of terms and conditions were set out]…"

(Our emphasis)

The following term was also included elsewhere in the Policy:

"The effect of a breach of condition precedent is that [the Insurers] are entitled to avoid the claim in its entirety.”

The High Court decision

Section 9 of the Act expressly prohibits an Insurer from converting a representation into a warranty or a condition precedent, whether by declaring the representation to form the basis of the contract or otherwise.

The High Court found that although sub-clause (i) was expressed as a condition precedent, it was in fact a representation about the insured’s trading position at the inception of the Policy. As such, it fell to be considered under Part 2 of the Act, which deals with the fair presentation of the risk.

As the Insurer had not based their defence on a breach of the duty of fair presentation and had not claimed any of the Section 8 proportionate remedies (such as part reduction in the claim), they could not rely on sub-clause (i) to repudiate liability.

Adopting a pro-policyholder interpretation, the Court held that each of the sub-clauses in the Duty of Assured clause had to be read together, meaning that sub-clauses (ii) and (iii) could not be relied upon either.

The Insurer appealed.

The Court of Appeal decision

Whilst the Court of Appeal agreed that sub-clause (i) was a pre-contractual representation dealing with existing contracts at policy inception, they disagreed that sub-clauses (ii) and (iii) had to be classified in the same way, stating that “the way they are grouped together in the policy does not justify… the “all or nothing” collective approach that was adopted by the judge."

That being the case, the heart of the appeal went to the characterisation of sub-clauses (ii) and (iii), and whether they were warranties and/or conditions precedent.

Answering that question, the Court ruled that the wording was clear, and that on a proper construction, sub-clauses (ii) and (iii) were warranties and conditions precedent to liability covering D&S’ future business operations, because:

- They were included under the heading “General Conditions, Exclusions and Observance”.

- The heading of the clause included the word “duty”, synonymous with an ongoing responsibility, obligation or burden.

- It was stated, in no uncertain terms, that the clause was “a condition precedent to liability”.

- The Policy contained, elsewhere, the following wording: “The effect of a breach of condition precedent is that [the Insurers] are entitled to avoid the claim in its entirety”.

Their categorisation as warranties meant that rather than being governed by the provisions of Part 2 of the Act, sub-clauses (ii) and (iii) fell to be considered under Part 3 of the Act, section 10(2), which provides that an insurer has no liability for any loss after a warranty has been breached but before it has been remedied. Since it had been established that the FSDF Terms were never incorporated into the contract between Scotbeef and D&S, D&S was in breach of the warranties and conditions precedent contained in sub-clauses (ii) and/or (iii), and the Insurer was absolved of any liability.

The Court of Appeal disagreed with the High Court’s interpretation that the Duty of Assured clause was an attempt to contract out of the Act because:

- The Duty of Assured Clause stated that it was subject to and incorporated the Act, which was “directly contrary to the type of wording that would be necessary to achieve any contracting out”; and

- Sub-clauses (ii) and (iii) did not place D&S in a worse position than it would have been in under the Act given that, under section 10(2) the Insurer is entitled to decline indemnity for breach of a warranty which has not been remedied.

Key takeaways for policyholders

The Court of Appeal decision highlights some of the difficulties policyholders may have in distinguishing between conditions precedent, warranties and pre-contractual representations in policies.

It is clear in a post-Insurance Act 2015 world that, although the ability of insurers to rely on conditions precedent and warranties has been limited, they are still of considerable use to insurers when properly applied. This decision confirms that underwriters are able to control the nature and extent of the risks they undertake through the use of appropriately worded duty of assured clauses, and warranties more generally, without contravening the provisions of the Act regarding the duty of fair presentation of risk (which the judgment of the lower court placed in doubt).

This decision is a salutary reminder for policyholders to ensure compliance with policy terms, and to seek support in identifying any conditions precedent to liability in order to ensure that an indemnity is available when needed.

Most importantly, for policyholders in the logistics and warehousing industry, where the value of goods stored or carried can be difficult to quantify and insurers manage their liability by requiring insureds to trade on industry terms, insurers will rely heavily on policy terms which require the incorporation of those terms, which limit liability and impose time bars on claims.

Abigail Smith is an Associate at Fenchurch Law

Climate Risks Series, Part 4: California Wildfires – Insurance Insights

Fenchurch Law firmly believes that an outstanding approach to claims payment is fundamental to the health of any insurance market. In fact, Lloyd’s of London’s modern reputation for excellence owes much to its response to the San Francisco earthquake in 1906, when leading underwriter Cuthbert Heath famously instructed his local agent to “pay all of our policyholders in full, irrespective of the terms of their policies”.

With extreme weather events including earthquakes, hurricanes and storms on the rise, the most recent wildfires in Los Angeles present a number of challenges, and also opportunities, for California’s insurance market.

Background

The fires originated in the canyons above the Hollywood Hills and were swept into residential areas by notoriously strong Santa Ana winds. Although the areas affected are known to be at risk of wildfires, it is unusual for them to occur in the winter months. This year, however, a combination of drought and abundant vegetation (the result of above average rainfall in the previous two years) resulted in there being ample fuel for the fires to spread.

Evidently, climate change is increasing the risk of wildfires in the area, with a study from Stanford University predicting that the frequency and potency of these fires will only continue to escalate in the future.

Now contained, the most significant fires were located in the Pacific Palisades and Eaton, primarily upscale residential areas surrounding the Hollywood Hills. The Pacific Palisades, in particular, is home to a wealth of high-value residential property, with average sale prices above $3 million. The impact of this is that insured losses are set to be the highest in California’s wildfire history, with JP Morgan’s most recent estimates at $20 billion. For context, California’s most expensive wildfire to date, the 2018 Camp Fire, resulted in insured losses of around $10 billion.

Beyond their initial response to claims payment, insurers will need to reconsider their approach to wildfire risk and implement resilience measures in order to continue to do business in the area, while maintaining adequate capital reserves and managing cumulative exposures.

A fragile home insurance market

In recent years, several leading insurers, including AIG and Chubb, have stopped issuing new home insurance policies in the state of California due to persistent losses against a backdrop of rising construction costs and property prices, with one deciding to reduce cover for 72,000 homes in the Pacific Palisades area. Underinsurance is a widespread problem.

At the end of last year, the California Department of Insurance sought to entice insurers back into the market by allowing them to use sophisticated catastrophe modelling and artificial intelligence to evaluate risk in fire-prone areas. That risk, together with the cost of any reinsurance, could then be factored into premiums. Unfortunately, the effect was that premiums soared, and it became increasingly difficult to obtain adequate cover at an affordable price.

In response, many homeowners opted to take out policies with the State-backed insurer of last resort, Fair Plan. Fair Plan distributes losses among a number of insurers based on their respective market share. If insufficient funds are available to cover its losses, Fair Plan can issue assessments requiring insurers in the voluntary market to contribute. If that happens, the Plan will impose a special assessment on home insurance policyholders across the State.

It is estimated that Fair Plan’s exposure in the Pacific Palisades alone is almost $6 billion, with luxury property specialists Allstate, Travelers and Chubb the most exposed. Post-Covid-19 construction prices could further increase final payouts, in addition to living expenses claims, typically capped at 30% of a property’s value. It has already been reported that regulators are allowing Fair Plan to collect $1 billion from private insurers to cover its recent losses.

The future

Following initial focus on the safe evacuation of residents, the State’s Insurance Commissioner has taken steps to mitigate the impact on California’s already fragile home insurance landscape, by issuing a moratorium preventing insurance companies from cancelling or not renewing policies in the affected areas for the next year. The Commissioner has also issued a notice to insurers urging them to go beyond their legal obligation and pay policyholders 100% of their personal property coverage limits without requiring them to itemize everything that has been lost.

The insurance industry has, historically, supported risk management in the aftermath of catastrophic events. It was the London market that established the first organised firefighting services when insurers hired their own firefighters to protect policyholder properties during the Great Fire of London in 1666, and it was Hurricane Andrew that changed the way insurers looked at hurricanes, and at natural catastrophes in general.

Following the 2018 Camp Fire, the Californian town of Paradise implemented a number of measures to build resilience to future fires, such as burying all power lines underground to reduce the risk of electrical sparks causing fires, requiring residents to remove vegetation in close proximity to their homes, and making grants available to homeowners willing to use fire-resistant materials in their rebuilding efforts.

At a property resilience level, the Insurance Institute for Business & Home Safety (IBHS) provides science-backed mitigation measures for homeowners to reduce the risk of wildfires igniting in their homes. The IBHS is an independent body, supported by the insurance industry to advance building science in order to reduce risk from natural hazards.

It remains to be seen whether the local insurance market will step up to deliver on the Commissioner’s request to pay out full policy limits without requiring proof of loss for every individual item, and how far mitigation measures will be implemented to respond to the difficulties that policyholders are likely to face in the coming months.

Given the impact of climate change, losses resulting from wildfires and other natural perils are likely to increase in severity in the future, highlighting the critical importance of a strategic approach to consumer protection and insurance market sustainability.

Abigail Smith is an Associate at Fenchurch Law

Climate Risk Series:

Part 1: Climate litigation and severe weather fuelling insurance coverage disputes

Part 2: Flood and Storm Risk – Keeping Policyholders Afloat

Part 3: Aloha v AIG – Liability Cover for Reckless Environmental Harm