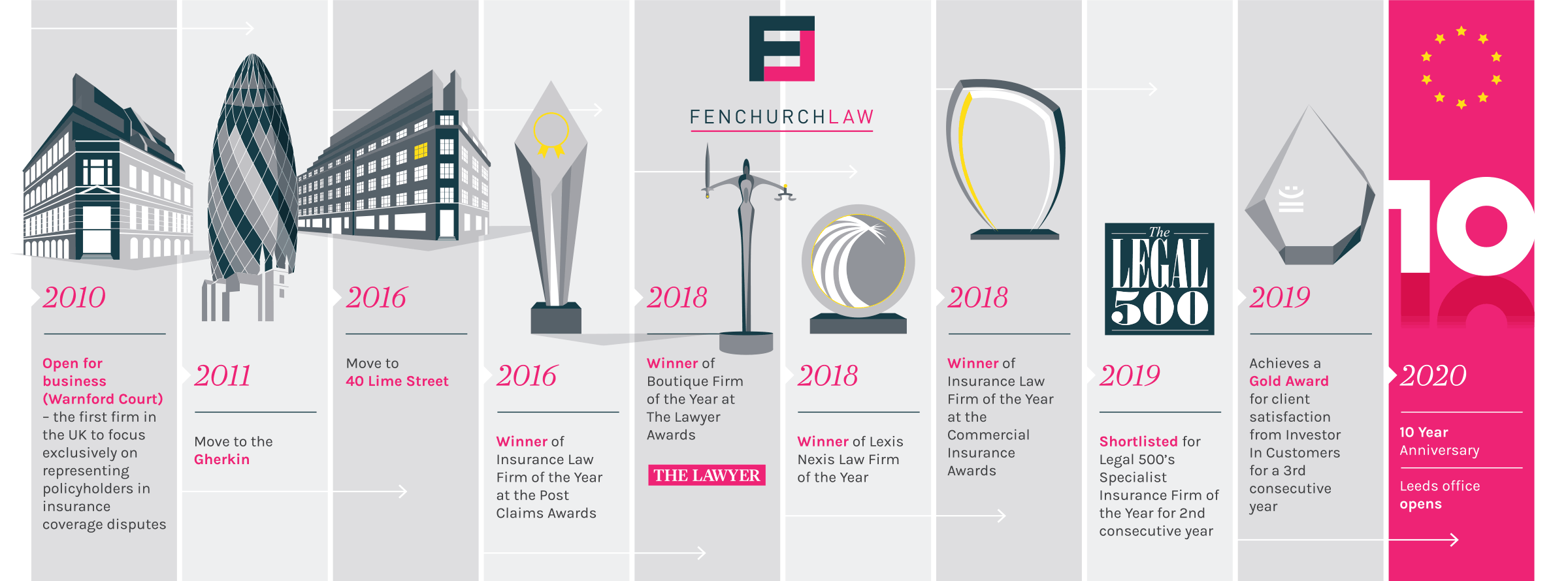

Our History

EC3, the traditional insurance district of London, is home to the oldest and most respected insurance market in the world, centred around Lloyd’s of London – which continues to lead the world in the placement of specialist insurance risks.

Lloyd’s of London’s modern reputation for excellence owes much to its response to the San Francisco earthquake in 1906, when leading underwriter Cuthbert Heath famously instructed his San Franciscan agent to “pay all of our policyholders in full, irrespective of the terms of their policies”.

An outstanding approach to claims payment is fundamental to the health of any insurance market. Many leading insurers continue to follow Cuthbert Heath’s approach and aim to ensure that honest policy holders with genuine claims are paid in full, as quickly as possible. Occasionally, the claims process doesn’t run as smoothly as it should do, and intervention is required to resolve the issues. Some, less scrupulous, insurers will only pay claims when they have no way to avoid doing so, and they may need to be compelled to behave correctly.

In the aftermath of the 2007 financial crisis the attitude of many London market insurers to claims hardened and some began routinely to seek to avoid paying valid claims. From 2007 it became increasingly apparent to the founders of Fenchurch Law that policyholders were often inadequately represented because their solicitors were not providing specialist services. Our firm was created in 2010 to allow policyholders access to the same specialist legal advice that insurers have enjoyed for decades. Our lawyers deliver the highest quality specialist legal advice exclusively to policyholders.

Every member of our team is a genuine insurance specialist and has extensive experience of the London insurance market. Equally importantly, every member of our team is passionate about serving the needs of policyholders and delivering the best possible outcomes. Many of the lawyers at Fenchurch law previously worked on the insurer side of the market in a variety of roles, including claims adjusters and defence lawyers.

As a result of our unrivalled expertise and unique insight into the insurance market, Fenchurch Law is regarded as the ‘go-to’ law firm for brokers and policyholders with difficult or complex insurance policy disputes. We are delighted that our client base and our work on complex and high-profile cases continues to expand as our reputation grows.

On your side

Our services

Specialist

Our practice groups

Our people

Our clients and their brokers draw confidence from the quality of the Fenchurch Law team.

When Clauses Collide: Court of Appeal Backs MRC Over New York Arbitration

20 February 2026

A recent Court of Appeal decision, Tyson International Company Ltd v GIC Re, India, Corporate Member Ltd [2026] EWCA Civ 40, provides valuable clarification on the approach taken by English courts…

Motor Finance and the FCA Redress Scheme: Insurance Coverage implications for policyholders

12 February 2026

Background and Supreme Court Decision The UK Supreme Court’s judgment in Hopcraft v Close Brothers Ltd, together with Johnson & Wrench v FirstRand Bank Limited [2025] UKSC 33, clarified the law…

A Vivid Reminder: Fire Safety Defects Can Trigger Cover

3 February 2026

Ten years on from Grenfell, fire safety defects remain one of the defining issues in the built environment. Against that backdrop, the recent decision in Vivid Housing Ltd v Allianz Global Corporate…